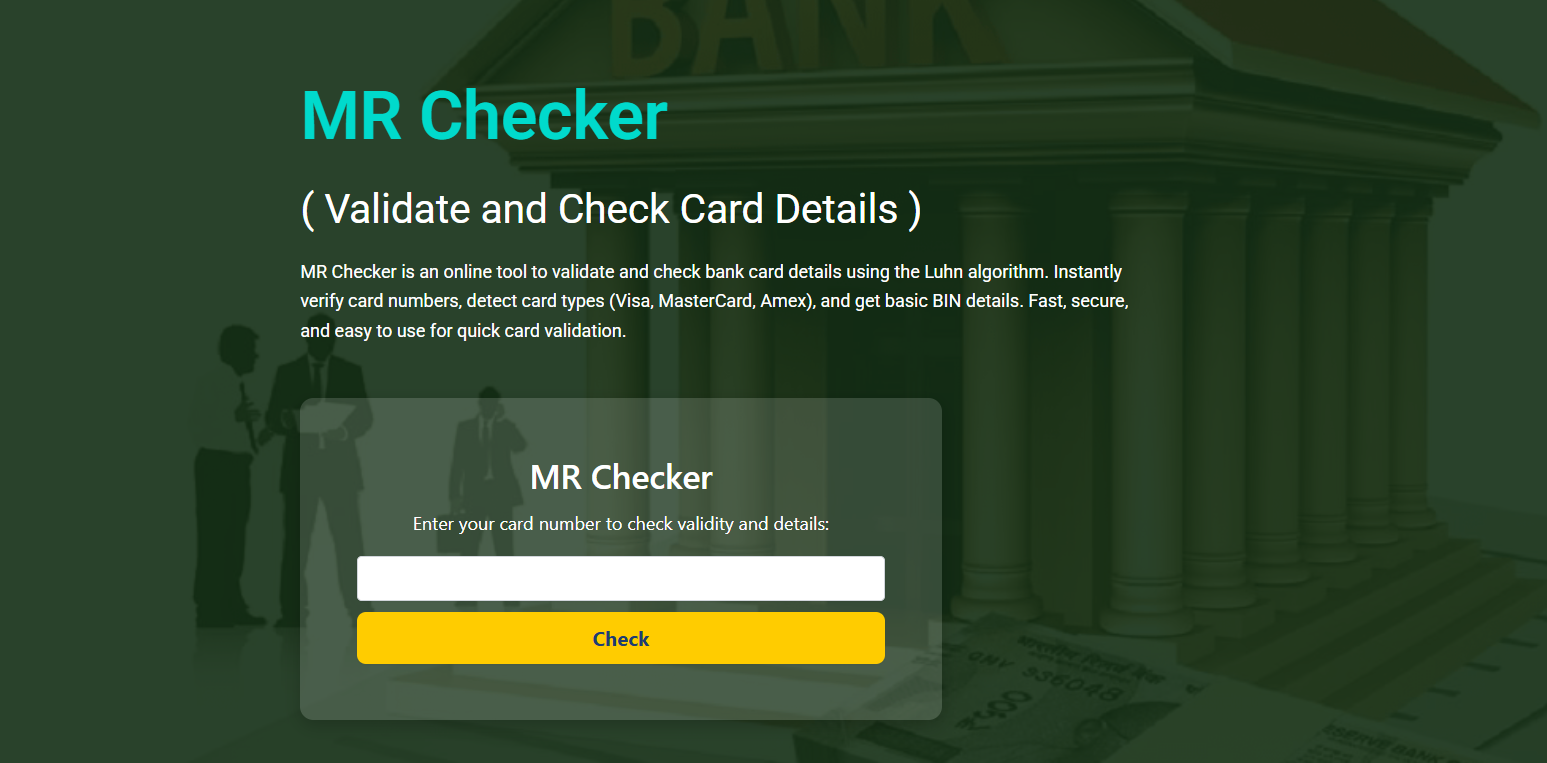

Is MR Checker Safe for Card Number Validation?

When using any online tool to validate sensitive information, safety is a top concern. MR Checker is a free platform that helps users validate credit card numbers instantly, but many first-time users naturally wonder if it’s truly secure. This concern is valid in a time when data breaches and privacy risks are all too common. Fortunately, MR Checker is specifically built with safety and privacy in mind.

Designed for testing, educational, and business use, MR Checker avoids storing, transmitting, or logging user data. The platform provides reliable, instant results using secure processes. It offers BIN lookup, card type detection, and number validation without requiring any user registration or financial information.

For anyone looking to verify card formats or detect card types, MR Checker offers a lightweight and privacy-conscious solution. But how exactly does it ensure safety? Here’s a closer look at the internal structure, features, and privacy practices that protect users.

MR Checker’s Safety Features

Built for Client-Side Processing

One of the key safety elements of MR Checker is that it processes validation tasks on the client side. That means the card number never leaves your browser. Unlike tools that send data to external servers for analysis, MR Checker does the work within the user’s device. This eliminates exposure risks during data transfer.

Client-side processing ensures your inputs are not logged or stored anywhere. It adds a layer of privacy by design and significantly reduces the risk of data interception or misuse.

No Account or Login Required

MR Checker does not require users to create an account or submit personal details. There are no hidden forms, email fields, or data submission points. You simply open the tool, enter a card number, and receive instant validation results.

This no-login model is essential for maintaining user privacy. It reduces data collection to zero, allowing users to remain completely anonymous while using the tool.

No Financial Transactions Involved

MR Checker does not process real transactions or connect to any financial networks. It is purely a structural validation tool, not a payment processor. This means that even if a real card number is entered, no transaction attempt is made.

Since it doesn’t interact with payment gateways or store financial data, the risk of financial compromise is nonexistent. It serves as a safe space for format checks without exposure to payment systems.

How the Tool Maintains User Privacy

Avoids Data Logging or Retention

MR Checker is designed not to log or retain any card numbers entered into the system. Once the validation check is complete, the number is discarded immediately. There’s no database or back-end storage tracking user activity or input data.

This approach aligns with best practices for privacy-focused tools. By eliminating data retention, MR Checker ensures users are not at risk even if they validate sensitive test data.

Designed for Anonymous Use

The tool’s interface is built for casual, quick use without tracking or cookies that follow the user. There are no analytics scripts monitoring how long users stay or what data they enter. This minimalistic, privacy-first design makes it ideal for secure environments.

Anonymous usage also appeals to developers, testers, and educators who need lightweight, secure tools for repeated use without leaving digital traces.

- No email input or user registration

- No cookies or behavioral tracking

- Immediate disposal of entered card numbers

Validating Card Numbers Safely

Use of the Luhn Algorithm

The Luhn algorithm is a well-established method used to validate credit card numbers mathematically. MR Checker applies this algorithm entirely within the browser to determine if the card number structure is correct. It checks digit patterns, sums values, and applies a checksum test.

This form of validation does not involve sending data anywhere. It ensures the card number is structurally sound without exposing it to any third-party systems. It’s a fast, secure way to pre-screen card entries.

Detects Card Type Instantly

MR Checker also determines card type based on the number prefix. Visa, MasterCard, American Express, and other brands follow distinct patterns. The tool identifies these using local scripts without accessing online databases.

By detecting card type instantly, MR Checker helps users understand which card brand is being entered. This enhances usability while maintaining local data processing and privacy.

Verifies BIN-Level Information

The first 6 to 8 digits of a card number form the BIN. MR Checker references an internal BIN database to fetch the issuing bank, card level, and country of origin. This process is performed internally and does not send any card data to external servers.

BIN details are displayed instantly on-screen and are not recorded or exported. The tool’s ability to offer this insight without data exposure is part of its privacy-focused architecture.

Use Cases That Benefit from MR Checker

Developer Testing and QA

For software engineers building or testing payment forms, MR Checker offers a reliable way to validate card number formats. Since it works without requiring a live transaction or exposing data, it’s ideal for QA environments. Developers can ensure that front-end logic handles all card types correctly.

It simplifies the testing phase by removing the need for mock gateways or dummy APIs. MR Checker is always available, lightweight, and non-intrusive.

Fraud Prevention Teams

Security teams can use MR Checker to analyze card numbers during fraud investigations. Identifying mismatched BIN data or card types can flag suspicious activity early. While it doesn’t replace full fraud systems, it supports early-stage validation and filtering.

This makes MR Checker a helpful tool in manual review processes or smaller-scale security audits where lightweight solutions are preferred.

Educational and Fintech Training

Students and instructors in fintech or cybersecurity fields often use tools like MR Checker for hands-on learning. It teaches how card validation works, what the Luhn algorithm does, and how card types are identified. These concepts are essential in payment systems training.

MR Checker provides a simple interface for practical exercises. Users can test various card patterns without using live payment gateways or exposing personal data.

- Simplifies validation testing during development

- Supports training sessions and educational demos

- Helps fraud analysts with manual data checks

Benefits of Using a Secure Tool

Lightweight and Fast Experience

MR Checker does not rely on complex back-end servers, which means it operates quickly without load times or delays. The simple interface ensures fast input, validation, and result delivery. This improves productivity for both casual users and professionals.

Its minimal design also helps it load fast on mobile and low-bandwidth networks. For secure environments with restrictions, this can be a major advantage.

100 Percent Free and Unrestricted

There are no fees, subscriptions, or locked features. MR Checker offers complete access without cost. This open-access model supports developers, businesses, and learners without budget constraints. Unlimited use means users can return any time without limits.

The lack of restrictions also supports testing multiple card formats, ensuring tools are well-vetted before deployment or launch.

Compatible Across All Devices

MR Checker works smoothly across desktop browsers, tablets, and smartphones. It doesn’t require installation or configuration, making it accessible on any platform. Responsive design ensures readability and functionality on all screen sizes.

Whether you’re validating cards from a laptop or mobile device, the safety protocols remain consistent and effective.

- No installation or software setup

- Works across Windows, Mac, Android, and iOS

- Always updated for modern browsers

Security Best Practices for Users

Avoid Using Real Cards

Even though MR Checker is secure, users should never input actual credit card numbers. It’s best to use test card numbers or dummy data during validation. This ensures full protection and aligns with safe usage guidelines for public tools.

Test cards are widely available for development use and do not contain real financial data. Using them with MR Checker offers peace of mind and compliance with ethical standards.

Pair with Local Testing Protocols

When using MR Checker for form validation or QA, always pair it with internal security protocols. This includes masking input fields, encrypting data where necessary, and never storing raw inputs. MR Checker is one part of a secure workflow, not a substitute for full data security systems.

By combining the tool with local development best practices, users can build safe, scalable payment interfaces.

Conclusion

MR Checker is a safe and reliable solution for validating credit card numbers without risking data privacy. With client-side processing, no tracking, and instant validation, it offers users a trustworthy tool for development, testing, and education. Its lightweight, secure design makes it the preferred choice for professionals who value privacy and performance.